XRP Price Prediction: Is It a Good Investment Amid Technical Consolidation and Conflicting Signals?

#XRP

- Technical Standoff: XRP price is consolidating tightly around its 20-day moving average ($2.1401), with Bollinger Bands indicating low volatility. A breakout above $2.32 or below $1.96 is needed for a clear directional trend.

- Conflicting Fundamentals: Extremely bullish long-term price predictions and ETF growth stories are juxtaposed against bearish on-chain activity, notably a $101 million XRP transfer to an exchange by Ripple, creating market uncertainty.

- High-Risk Proposition: The investment case is binary, relying on bullish narratives overcoming near-term selling pressure and skepticism. Prudence suggests waiting for a clearer technical confirmation or fundamental resolution.

XRP Price Prediction

XRP Technical Analysis: Consolidation Near Key Moving Average

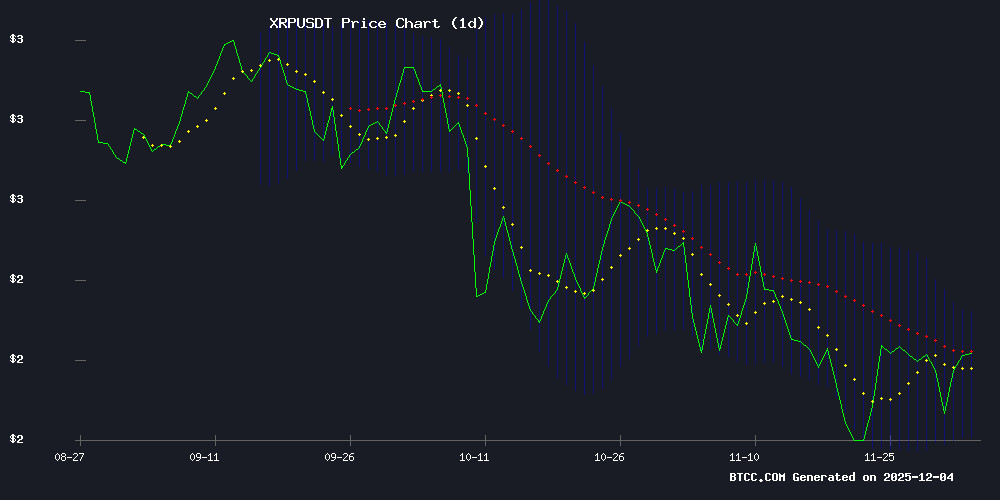

As of December 4, 2025, XRP is trading at $2.1391, exhibiting a tight consolidation pattern around its 20-day moving average (MA) of $2.1401. This price action suggests a critical equilibrium point where buyers and sellers are in a temporary standoff.

From a technical perspective, the MACD indicator presents a mixed signal. While the MACD line at 0.0149 remains below the signal line at 0.0758, indicating potential short-term bearish momentum, the histogram value of -0.0609 shows that the negative momentum may be decelerating.

The Bollinger Bands analysis offers clearer context. With the current price positioned just below the middle band, and the bands showing a width of approximately $0.36 between the upper ($2.3218) and lower ($1.9584) boundaries, XRP appears to be in a period of low volatility compression. 'This setup often precedes significant directional moves,' notes BTCC financial analyst Olivia. 'A sustained break above the 20-day MA could target the upper Bollinger Band NEAR $2.32, while failure to hold support might see a test of the lower band around $1.96.'

Divergent Sentiment: Bullish Narratives Clash with Bearish Market Flows

The news landscape for XRP presents a stark contrast between optimistic community projections and concerning on-chain activity. Headlines tout ambitious price targets ranging from $27 to even $50,000, fueled by narratives of supply tightening, rising institutional demand, and the potential of XRP ETFs nearing a $1 billion milestone. Ripple CEO's comments on 'early-stage growth' further feed this bullish narrative.

However, this Optimism is directly challenged by concrete market actions. The most significant data point is Ripple's transfer of $101 million worth of XRP to Binance, an event typically associated with increased selling pressure or liquidity provisioning. 'While the community focuses on long-term prophecies, the market is reacting to immediate supply dynamics,' states BTCC financial analyst Olivia. 'The movement of such a large sum to a major exchange, coupled with growing mentions of bearish sentiment and market headwinds in the headlines, creates a fundamental dissonance. The bullish predictions must be weighed against this reality of potential near-term distribution.'

This creates a market sentiment best described as cautiously conflicted. The strong bullish headlines provide a fundamental story for long-term holders, but the technicals and certain on-chain flows advise short-term prudence.

Factors Influencing XRP’s Price

XRP Community Pushes Back Against Claims of Institutional Replacement

An influential figure within the XRP community has dismissed assertions that major financial institutions will abandon the XRP Ledger (XRPL) in favor of proprietary blockchains. Vet, a dUNL validator on the XRP Ledger, publicly ridiculed the argument, labeling it as one of the weakest critiques against XRPL's viability.

The debate centers on whether large-scale adopters would opt to develop their own distributed ledger systems rather than leverage XRPL's established infrastructure. Market participants increasingly view such claims as speculative, given XRP's entrenched use cases in cross-border payments and institutional partnerships.

Analyst Predicts XRP Breakout to $27 Amid Market Uncertainty

Cryptocurrency analyst EGRAG has identified a potential breakout pattern for XRP, suggesting the asset could surge to $27 following a triangle formation. The prediction comes as market participants weigh conflicting signals about the digital asset's trajectory.

"All roads lead to Rome," EGRAG remarked, indicating multiple technical pathways could converge on the $27 price target. The analysis highlights XRP's resilience during recent market volatility, with the triangle pattern typically signaling consolidation before decisive moves.

XRP Price: Gemini Predictions Signal Crucial December Setup

XRP enters December with bullish momentum as technical indicators and on-chain activity converge. The $2.28 Fibonacci level emerges as a critical resistance zone—a breakout could propel prices toward $3.10, last seen in early October.

On-chain metrics show accelerating network velocity, suggesting renewed institutional interest. Whale accumulation patterns mirror the buildup before Q3's 40% rally, while exchange reserves hit 18-month lows—a classic supply squeeze precursor.

Ripple Moves $101 Million in XRP to Binance Amid Market Speculation

Ripple has transferred 46 million XRP tokens, valued at approximately $101 million, to Binance. The transaction, tracked by Whale Alert on December 4, underscores Ripple's active management of its holdings as market interest in the cryptocurrency grows.

While the purpose of the transfer remains unclear, such movements are often linked to liquidity management or preparatory steps for future operations. The timing coincides with a broader crypto market correction, yet some interpret the move as a bullish signal for XRP's prospects—particularly given rising interest in spot ETFs for the asset.

Technically, XRP shows signs of a potential 20% breakout if it clears the $2.28 resistance level. The token has been forming higher lows, reinforcing bullish sentiment among traders.

XRP Faces Market Headwinds as Bearish Sentiment Grows

XRP's downward trajectory continues to unsettle investors, with the token now trading at $2.13—a 1.3% decline over 24 hours that extends its week-long slump. The current price represents a stark 40% retreat from July's peak of $3.65, signaling eroding confidence among market participants.

Market dynamics reveal deepening bearish pressure. Daily spot trading volume plummeted 27% to $3.41 billion, reflecting dwindling participation. CryptoQuant data shows funding rates entrenched in negative territory, indicating overwhelming short positioning. This derivatives imbalance suggests potential further downside toward the $1.9-$2 support zone, though extreme negative funding could trigger a short-covering rebound toward $2.20.

Tradeship University Founder Advocates Exclusively for XRP, Dismisses Other Cryptocurrencies

Cameron Scrubs, founder of Tradeship University, has reiterated his unwavering bullish stance on XRP, urging investors to concentrate solely on the digital asset. "Buy XRP," Scrubs declared in a recent social media post, adding that other cryptocurrencies "don’t matter." His comments reinforce a long history of bold predictions about XRP’s potential.

The remarks come amid a broader market where investors often diversify across multiple tokens. Scrubs’ high-conviction approach stands in stark contrast, positioning XRP as the singular focus for meaningful returns.

XRP Supply Tightens, Signaling Potential Major Price Move

Market analysts are noting a tightening supply of XRP, a condition that historically precedes significant price movements. The observation comes from community commentator XFinanceBull, who cited data from fellow analyst Mullen showing dwindling available supply.

"When XRP supply contracts, the subsequent moves are never small," remarked XFinanceBull, echoing a sentiment familiar among seasoned XRP traders. The current supply dynamics mirror patterns seen before previous rallies, though no specific price targets were suggested.

XRP Ledger Velocity Hits 2025 Peak Amid Rising Institutional Demand

XRP's on-chain activity surged as the XRP Ledger recorded its highest velocity level of 2025 at 0.0324, according to CryptoQuant data. Over 2.23 billion XRP changed hands in a single day, signaling heightened network demand from traders and institutional buyers.

Exchange outflows accelerated as ETF players accumulated positions. The velocity spike suggests capital rotation rather than stagnant holdings—a historically bullish indicator for price momentum.

RealFi adoption adds fuel to the rally. Real Token's December 5 exchange listing marks a pivotal step in bridging real estate assets to XRPL, potentially unlocking access to the $650 trillion property market through blockchain rails.

XRP Tests Key Resistance Amid Institutional Inflows

XRP surged 6% to $2.17 after defending the $2 support level, with traders now eyeing the $2.28-$2.30 resistance zone as a decisive breakout point. A daily close above this threshold could confirm a trend reversal—the first since July—potentially propelling the token toward $2.58.

Institutional interest grows as XRP ETFs notch 11 consecutive days of net inflows, pushing assets under management to $844 million. A single-day inflow of $89 million on December 1 underscores accelerating capital deployment.

Futures markets tell a cautionary tale: negative funding rates and a 56% drop in open interest to $3.8 billion reflect dominant short positioning. This sets the stage for a potential short squeeze should bullish momentum sustain.

Technical indicators flash mixed signals. While RSI divergence hints at upside potential, failure to hold $2 support risks a retracement to $1.90. The $2.34-$2.42 range may trigger profit-taking among early bulls.

XRP ETFs Near $1B Milestone as Ripple CEO Touts Early-Stage Growth

XRP exchange-traded funds are approaching $1 billion in assets under management, signaling accelerating institutional demand. Ripple CEO Brad Garlinghouse framed the momentum as evidence of being "still early" in the adoption curve, despite the cryptocurrency's decade-long history.

The surge follows a wave of new listings from traditional finance heavyweights, with market makers attributing the inflows to growing regulatory clarity and infrastructure maturation. XRP remains one of the few non-Bitcoin digital assets to attract meaningful ETF investment.

XRP Forecast: $10K-$50K Price Target Tied to Global Liquidity Flows

KING VALEX, a prominent XRP community figure, projects a five-digit future valuation for the token, citing institutional adoption as the key driver. The $10,000-$50,000 range reflects anticipated demand from global payment systems and central bank digital currencies (CBDCs).

This bullish scenario hinges on XRP becoming the backbone for cross-border settlements, potentially displacing legacy systems like SWIFT. Market observers note the forecast aligns with growing institutional interest in blockchain-based liquidity solutions.

Is XRP a good investment?

Determining if XRP is a good investment requires balancing its long-term potential against significant near-term uncertainties. The current technical picture shows a coin in consolidation, trading almost exactly at its 20-day moving average of $2.1401. Key levels to watch are resistance at the Bollinger Band upper limit of $2.3218 and support at $1.9584.

The fundamental backdrop is polarized. On one hand, there are powerful bullish narratives:

- Predictions of parabolic moves to $27 or higher.

- Growing institutional interest and ETF development.

- A tightening supply, which could support price appreciation.

On the other hand, concrete risks are present:

- Ripple's recent transfer of over $100M in XRP to an exchange, suggesting potential selling pressure.

- Market sentiment currently described as 'bearish' and facing 'headwinds'.

- The MACD indicator remains in a bearish configuration.

As BTCC financial analyst Olivia summarizes: 'XRP presents a high-risk, high-reward proposition. The investment thesis hinges on whether the bullish institutional and adoption narratives will materialize with enough force to overcome the persistent overhang of Ripple's escrow releases and market skepticism. For most investors, it may be prudent to wait for a clearer technical signal—such as a decisive break above $2.32 with high volume—or for a resolution of the conflicting fundamental flows before committing significant capital.'

Here is a summary of the key technical data:

| Metric | Value | Implication |

|---|---|---|

| Current Price | $2.1391 | Neutral, at equilibrium |

| 20-Day MA | $2.1401 | Immediate resistance/support level |

| Bollinger Upper Band | $2.3218 | Key resistance for bullish breakout |

| Bollinger Lower Band | $1.9584 | Key support for bearish breakdown |

| MACD Histogram | -0.0609 | Bearish momentum, but possibly weakening |